In this significant shift to help businesses and enhance voluntary compliance with tax laws, the Federal Tax Authority (FTA) of the UAE has delivered a brand new initiative to waive administrative penalties for late corporate tax registration UAE applications. This improvement is a part of the FTA’s ongoing efforts to simplify the tax process and inspire businesses to fulfill their legal-duties without dealing with undue financial burden. The initiative, introduced on May 7, 2025, gives businesses the good opportunity to avoid penalties/hefty-fines associated with delayed registration, provided they meet certain conditions.

Key Details of the FTA Penalty Waiver 2025

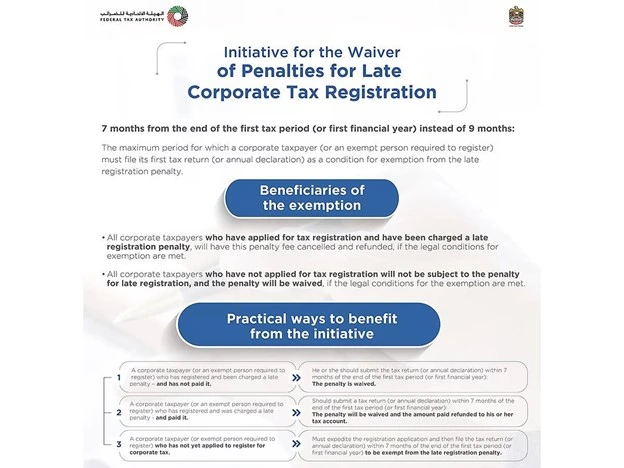

The FTA’s penalty waiver applies especially to company taxpayers who did not submit their tax registration application by the prescribed deadline. The important requirement for businesses to enjoy the waiver is the timely submission of their tax-return or annual declaration within seven months from the end of their first tax-period (or first financial-year). This deadline is considerably shorter than the previously formerly allowed nine months, which provides an element of urgency for businesses to submit quickly.

To ensure clarity, the FTA has emphasized that this waiver simply applies to the first tax-period or first financial-year of the taxpayer, no matter whether or not the due date for submitting the tax-return or annual declaration falls before or after the implementation of the brand-new decision.

Furthermore, businesses that have already paid penalties for late corporate tax registration can gain from this initiative as well. If those businesses submit the mandatory tax documents within the specific time frame, the FTA will refund the penalties paid, crediting the amount to the taxpayer’s account.

Who Can Benefit from the UAE Corporate Tax Penalty Waiver?

This initiative applies to all businesses that can be required to register for company tax. Whether your business has already been penalized for late registration or you haven’t but submitted a registration application, you can still qualify for the penalty waiver so long as you fulfill the subsequent conditions:

-

Registered with the FTA but Penalized for Late Submission: If your company is already registered and you received a late submission penalty but have not paid it, you must submit your tax return or annual statement within seven months from the end of your first tax-period. By doing so, the penalty can be waived.

-

Already Paid the Penalty: If you’ve already paid the late registration penalty, you can still receive a reimbursement in case you submit the required tax files on time.

-

Have Not Yet Registered: For businesses that have not yet submitted a corporate tax registration application, the key is to expedite the registration process and ensure the tax-return or annual statement is submitted within seven months of the first tax–period or financial-year.

Scenarios to Understand the FTA Tax Registration Penalty Relief

To assist businesses in recognizing how the penalty relief works in practice, let’s discover some possible scenarios:

Scenario 1

-

Situation: A company has finished its registration and obtained a penalty for late submission. However, the penalty has not yet been paid.

-

Outcome: If the company submits its taxes within seven months of the first tax-period, the late registration penalty can be waived.

Scenario 2

-

Situation: A company has registered for corporate tax and received a penalty for late submission. However, the tax-return has not yet been submitted.

-

Outcome: The penalty can be waived if the tax-return or the annual declaration is submitted within seven months from the end of the first tax-period.

Scenario 3

-

Situation: A company has already paid the late registration penalty but has not yet filed the tax return.

-

Outcome: If the company submits the tax-return or annual declaration within the seven-month duration, the penalty amount paid will be refunded to the taxpayer’s account.

Scenario 4:

-

Situation: A company has not yet submitted a company tax registration application.

-

Outcome: The company will want to finish the registration and submit the tax-return or annual statement in the specific time-frame to qualify for the penalty waiver if the penalty becomes imposed.

How to Apply for the UAE Corporate Tax Penalty Waiver

To benefit from the penalty waiver, businesses must complete their corporate tax registration and submit the applicable tax files via the FTA’s EmaraTax platform. It is crucial to fulfill the deadline of 7 months from the stop of the primary tax–period or financial-year to ensure eligibility for the penalty exemption.

In his remarks at the initiative, H.E. Khalid Ali Al Bustani, Director-General of the FTA, advised all unregistered businesses to take instantaneous action. He advocated all company taxpayers to conform with tax registration and submission closing dates to avoid penalties and to enjoy the FTA’s help.

The FTA’s Broader Vision: Fostering Voluntary Compliance

This penalty waiver is a part of the FTA’s large approach to streamline tax procedure for businesses and promote voluntary compliance with the UAE’s tax laws. H.E. Al Bustani highlighted that the UAE authorities are eager to develop a transparent, flexible, and green tax environment that fosters financial increase while making sure that businesses meet their duties.

The FTA has additionally praised the developing awareness and participation in company tax registration, with more than 543,000 registrations completed within the first quarter of 2025. This high registration rate signals a positive trend toward extra compliance and awareness among businesses about the importance of adhering to tax laws.

The FTA’s method isn’t just enforcement, however; it also approximately assists businesses via training and simplified tax processes. Through non-stop engagement and outreach, the FTA’s goal is to create a surrounding in which businesses can easily understand their responsibilities and fulfill them efficiently.

Conclusion

The FTA’s initiative to waive penalties for late corporate tax registration offers a good opportunity for organizations to rectify any past errors without incurring financial penalties. By acting directly to fulfill the brand-new deadlines for tax-return submission, organizations can avoid fines, get admission to refunds, and stay compliant with the UAE’s company tax laws.

If you’re a business owner or corporate taxpayer, now is the time to take advantage of this initiative. Ensure that your registration is complete and your returns are filed on time, and you may benefit from the FTA’s waiver. For guidance and assistance, organizations can continually flip to experts who specialize in corporate tax compliance to navigate the process smoothly.

Need Help?

ebs Chartered Accountants in Dubai can help organizations with seamless company tax registration and filing and ensure they are in complete compliance with FTA regulations. Their professional team offers tailor-made help to assist customers in navigating tax approaches and avoid penalties, making sure your enterprise remains compliant with the UAE company tax penalty waiver.

FAQs

What is the FTA penalty waiver 2025?

It’s a relief initiative by the UAE’s Federal Tax Authority to waive penalties for late corporate tax registration under certain conditions.

Who is eligible for the FTA tax registration penalty relief?

Businesses that register and file their tax returns within 7 months from their first tax period can qualify.

Will paid penalties be refunded under this initiative?

Yes, if the tax return is submitted within the 7-month window, any paid penalties will be credited to the taxpayer’s FTA account.

How do I apply for the UAE corporate tax penalty waiver?

Register and file your tax return on EmaraTax within 7 months from your first tax period to automatically benefit.