Due to its modernization of logistics infrastructure and its easy access throughout the globe, UAE has been an important point of reference for trade transactions that take place in the Middle East. Additionally, the positive efforts of authorities of UAE government have played an important role to aid in the promotion of imports and exports of the firms in a controlled setting by constantly implementing excellent practices around the globe.

Value Added Tax in Dubai (VAT) is charged for goods and services purchased or purchased within the UAE. In certain cases, the importation of goods may be made by VAT registered agents working for VAT registered individuals in the UAE. If the agent imports items on behalf of a tax-paying person the tax value of the items being imported will automatically be reflected by the agent’s VAT account. In the case of import transactions, businesses employ agents on their behalf and handle all processes for clearing. In addition, there are situations in which companies delegate responsibility for imports to their customers adequate to the terms of agreement between them. Then they will serve as agents for who owns the product.

What is the VAT accounting procedure when an agent imports goods in the UAE?

The agent has to provide all necessary import documents in order to receive approval from the customs. Along with the import documentation, the agent will need to focus on providing the Tax Registration Number (TRN) when importing products. After the agent has provided an TRN the price of goods imported will be automatically filled in on the next Tax return Form (Form number. 201) of the agent. It will calculate VAT on imported goods, as well as the net tax owed from the agents. There is a separate section in the VAT return listed below (Box #6) to automatically calculate the value of goods imported.

![]()

Who can claim the VAT charged during the import of goods made by an agent in the UAE?

The FTA has explicitly clarified that only the person who owns the item can claim to recover any VAT that is incurred in the importation of products. Even if an agent assisted in the importation for the owner, and the import value is included in the VAT return filed by agents, they is not able to claim to recover the VAT.

How can a business owner collect VAT when importing goods through an agent in UAE?

The owner of the import products can claim the VAT on imports by two methods as described below:

- Tax return adjustments made by the agent as well as owners of product

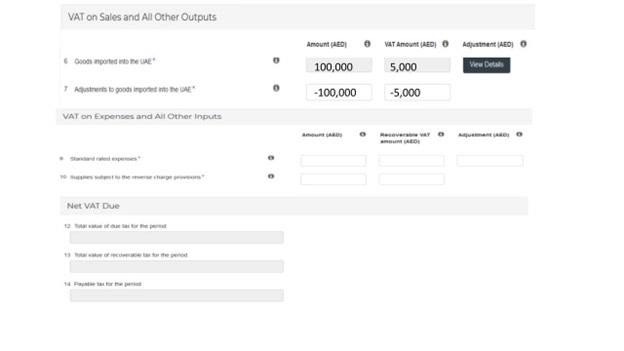

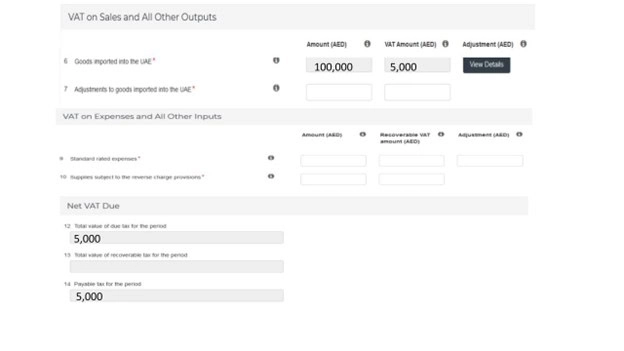

In order to allow the collection of VAT on imports from the owner who actually owns the product, a adjustment field has been included on the form for VAT returns 201, as below (Box number 7). Adjustments must be manually entered by both the owner and agent on their VAT returns based upon the written agreement between the two. The agent is required to make a negative adjustment in order to erase the value of goods imported automatically entered into the tax return however, the owner is required to make an adjustment of positive value in order to show the amount of imports in the VAT return. When these adjustments are incorporated by both parties on their VAT returns the VAT impact for the goods imported that the agent has arranged to be omitted from the return of the agent, and will be accurately reflected in the VAT return of the owner of the item. Owners of item will then be able to recover the VAT according to the general rules of VAT recovery.

- A tax receipt is sent by an an agent to the owner to import VAT

The owner and both the agent can agree in advance to not adjust tax returns. In these situations, agents are required to pay VAT to FTA that will be calculated according to the value of import products automatically entered in the VAT return. In the event that VAT is that is paid on behalf by an agent for the owners the agent may send a letter to the owner that includes the information below:

- The date of the statement

- Date of import

- Name, address, and TRN of the agent

- Details about the import of imported products

- The amount of VAT that is that is paid

The statement could be regarded as a tax invoice issued by owners of product and used for reimbursing the amount to the agent, and to collect the input tax in accordance with the general rules for VAT recovery.

Example

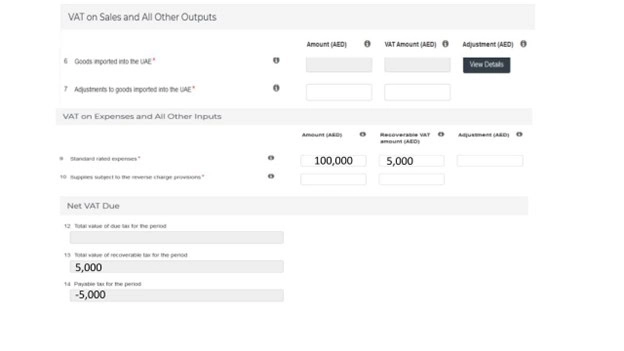

Agent A imports tax-exempt products on behalf of a manufacturing company called ‘B’ (assume that it produces only tax-deductible goods) that have a value of goods at AED 100,000. Each is VAT-registered in Dubai, UAE. When completing the import clearance “A” submitted his TRN. The VAT amount for this particular transaction is AED 5 000 and the procedure is described in the following scenarios.

Scenario 1

A and B are in agreement for adjustments to both their VAT return

On the return of VAT for A, the particular import of goods from the example will be reported as follows:

When you file the return of VAT for B, the particular import of goods as in the example will be recorded as follows:

Scenario 2

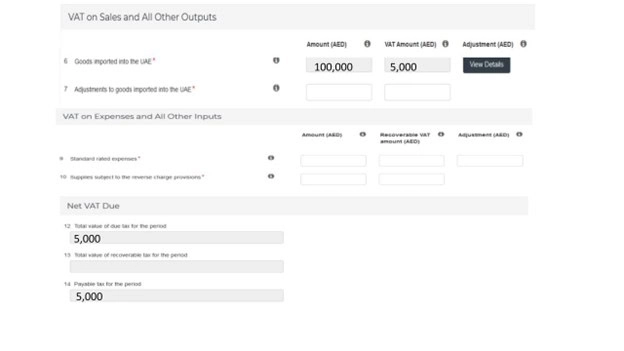

A and B accept to not adjust both their VAT returns. A issues an invoice for tax at B to pay the tax that was paid to FTA

On the return of VAT for A, this specific import of goods in this example will be reported as follows:

On the tax return for B, the particular import of the goods in the case will be recorded as follows:

Best VAT Consultant in Dubai, UAE

Businesses operating in UAE have gained an accurate understanding of VAT consequences of importing goods through an agent for a VAT-registered person in the UAE or another tax accounting method for the importation of products. If you are still having questions, get in touch with ebs chartered accountants. They will receive professional VAT-related advice from UAE to help you clear any doubts about tax consequences of imported goods.

FAQS

What are the VAT implications when importing goods by an agent on behalf of a VAT registered person in the UAE?

When goods are imported by an agent for a VAT registered person, the agent is considered the importer of record and is responsible for paying VAT at the point of import.

Can the VAT registered person reclaim the VAT paid by the agent on imported goods in the UAE?

Yes, the VAT registered person can reclaim the VAT paid by the agent on imported goods as input tax, subject to compliance with VAT regulations and documentation requirements.

Are there specific documentation or procedures that need to be followed when importing goods by an agent for a VAT registered person in the UAE?

Yes, proper documentation, such as a valid import declaration and VAT invoice, must be maintained to support the reclaim of input tax by the VAT registered person.

How can VAT registered persons ensure compliance and optimize VAT implications when importing goods through an agent in the UAE?

VAT registered persons should work closely with their agents to ensure proper VAT treatment, maintain accurate records, and seek guidance from tax experts to navigate VAT implications effectively.